Professional Employer Organization

Get full-service HR, payroll, benefits for your US employees

Our PEO is a hands-on outsourcing partner managing HR, payroll, tax, employee benefits, and more. Receive dedicated compliance experts to help protect your business.

Unified Platform

Grow your business faster with built-in compliance

Win back your time with PEO handling payroll and tax, HR, compliance and benefits work for you. Tap into affordable, big-company benefits plans your employees will love.

- Compliance answers from a dedicated HR Business Partner

- Top employee benefits and 401(k) tailored to your business

- Payroll and tax filings done across federal, state, and local levels

- 24/7 support through chat, email, and Slack

Designed for US and international companies

Whether you’re in multiple US states or expanding to the US for the first time, grow faster without the costly HR overhead.

We handle compliance paperwork for you

Our experts monitor compliance changes and keep you up-to-date for payroll and tax, HR policies, employee handbooks, benefits, workers’ compensation, and more.

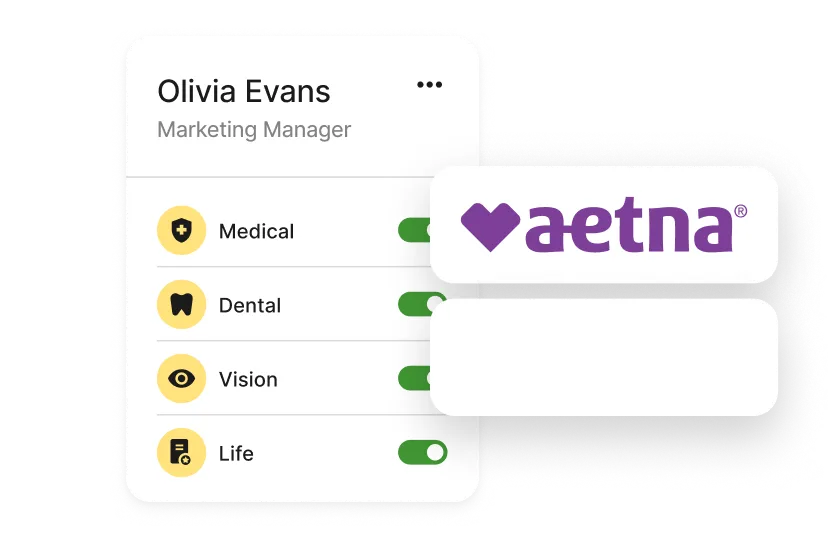

Flexibility to keep your current benefits plans

PEO adapts to your business, whether you use our employee benefits or your existing provider. Scale into our benefits plans later if you want.

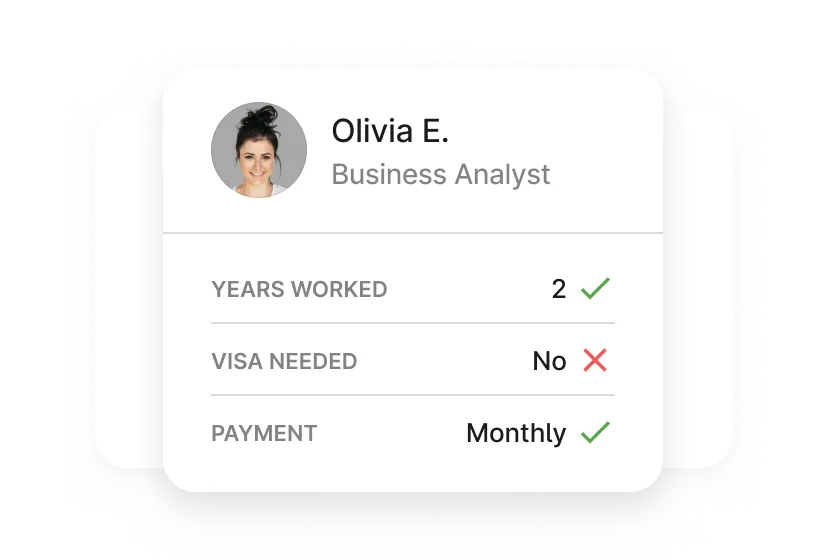

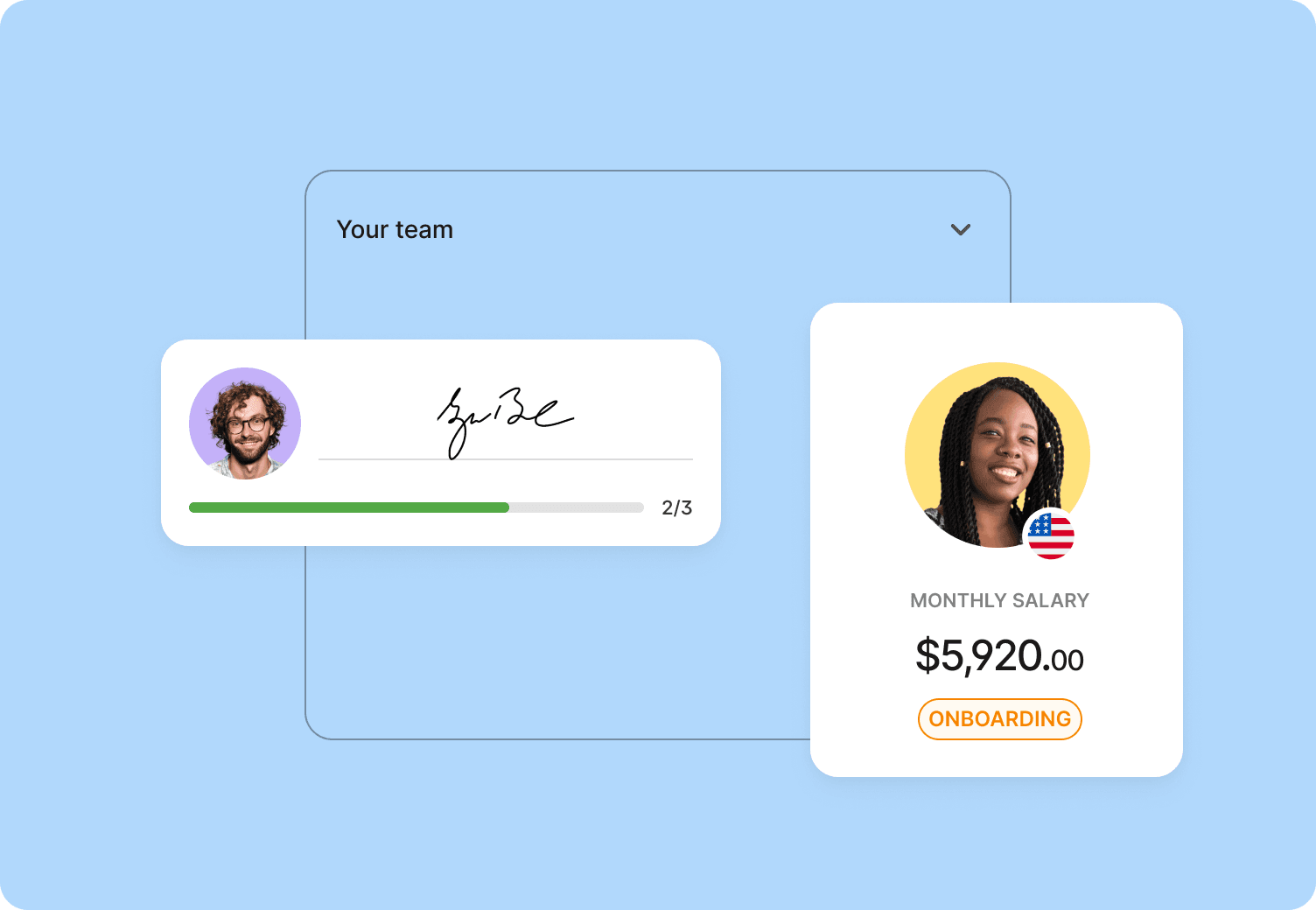

Manage your team in our all-in-one PEO

Decrease onboarding time to just 5 minutes

Onboarding needs can differ state to state. That’s why we localize every item for you—from minimum wage to state-specific documents—so you can quickly, compliantly onboard anyone.

Comprehensive HR

HR support to help protect your business

Deel’s team of experts help you navigate compliance complexities and adapt best practices, so you’ll meet every HR challenge with ease.

- Leave of absence administration and state unemployment filings

- Employee handbook with policies, procedures, and guidelines

- EPLI to help protect from costly employment claims

- Guidance on EEOC, FMLA, OSHA, COBRA and SUI compliance

Attract top talent with Fortune 500 level benefits

Access benefits from market-leading carriers that are normally out of reach for small businesses. We provide competitive health insurance, 401(k) retirement plans, and other voluntary benefits your employees will love.

Better healthcare

Access national medical plans from Aetna and Kaiser Permanente, including international plans for globally mobile employees. Plus, dental, vision, and life insurance options.

Retirement plans

Stand out of the crowd with best-in-class 401(k) plans, administration, and compliance.

Supplemental health benefits

Empower your employees with mental health services, HSA/FSA, fertility benefits, critical incident plans, AD&D, hospital indemnity plans, plus personal coverage options from Metlife.

see it in action

Take a tour of our all-in-one PEO

FAQs

Why use PEO services?

A professional employment organization (PEO) is a service provider that handles HR services on behalf of an employer for US workers, including:

- Payroll processing

- Tax administration

- Compliance support

- Onboarding and offboarding

- Employee benefits administration, including health insurance and ACA compliance

- Worker’s compensation coverage and claims

- Candidate screening

- HR policies and employee handbook templates

- Family and medical leave

- Salary and market comparison data

A PEO can be an excellent solution for outsourcing your domestic HR duties. They can relieve your businesses of many HR-related tasks, offer domestic compliance support in all supported states, and save you money.

What is co-employment? How does it work with PEO?

When a company engages with a PEO, they enter into a co-employment arrangement. As co-employers, the PEO and client contractually share employer responsibilities and liabilities. Both parties outline the allocation of these responsibilities in a PEO agreement (also known as a PEO client service agreement).

The client company retains ownership and control over its operations, including day-to-day management of employees and product development, marketing, sales, and service. The PEO will typically assume responsibility for administrative tasks, employee records, employee benefits, payroll processing, and employment taxes.

How is PEO different than an EOR solution?

A PEO is a US-only service that uses a co-employment model and shares compliance liability (as the employer of record for payroll and tax). It delivers full-service outsourcing for HR, compliance, payroll/tax, and employee benefits. Access expert HR guidance and support across all 50 US states to help protect your business from risk and noncompliance.

An EOR solution is available globally, including the US, and assumes full compliance liability. An EOR legally hires employees on your company’s behalf and handles onboarding, HR admin and compliance, payroll, and tax. An EOR doesn’t require a legal entity in the country you’re hiring, while you do need a US legal entity with a PEO.

For more details, check out this PEO vs. EOR comparison.

How much does a PEO cost?

PEOs will charge an administrative fee for their services, often using one of two pricing structures: a fixed monthly fee per employee, usually around $1,000 per employee annually, or a percentage of your overall payroll, usually 2-11%.

See PEO pricing and get started with a custom quote. Unlike some PEO providers, we provide transparent pricing and no separate fees for platform, payroll and benefits admin access, and more.

Does a PEO replace my HR department?

No. Outsourcing to a PEO is not about replacing your HR team. Instead, it’s about working collaboratively with your existing team to bolster your HR functions and ensure you meet full regulatory compliance. Your team is probably doing many tasks they don’t need to.

A PEO frees your HR team to concentrate on more in-depth strategic matters that require a deep knowledge of your company and its plans. It’s also important to note that a PEO does not manage staffing or provide employee leasing, as your HR department retains recruitment responsibilities.

How do I select the best PEO provider?

When selecting the best PEO provider, it's crucial to consider a few key factors.

First and foremost, prioritize pricing transparency and opt for a PEO that breaks down costs by line item rather than presenting confusing bundled prices.

HR support from a PEO is critical in staying compliant. A PEO offering HR generalists and dedicated payroll support ensures faster, direct service compared to PEOs relying on a 1-800 hotline model. At Deel, you can rely on comprehensive HR support from our in-house HR, compliance, and payroll experts.

Evaluate flexibility in working with preferred brokers, as some PEO companies may limit this option. Deel offers you the freedom to choose. You can keep your existing broker and benefits plans, or access our PEO health plans from leading carriers at affordable rates.

Deel makes growing remote and international teams effortless

150+

countries

40,000+

customers

$20B+

compliantly processed global payroll

90+

NPS for enterprise customers